[ad_1]

Contrary to a misguided Cambridge University study, Bitcoin mining leverages 52.6% sustainable energy, making it an appealing ESG investment.

This article provides a look at my latest research, revealing how it came to be that a 2022 Cambridge Centre For Alternative Finance’s (CCAF) study on Bitcoin’s environmental impact underestimates the amount of sustainable Bitcoin mining going on. I also address why we can be very confident that the actual sustainable energy usage is at least 52.6% of Bitcoin mining’s total energy use.

Why This Matters

Whatever your position on ESG investment, the reality is that it’s soaring, on track to reach $10.5 trillion in the U.S. alone. What’s also true is that Bitcoin adoption cannot occur unless this $10.5 trillion of ESG funds feels comfortable that Bitcoin is a net positive to the environment.

Right now, ESG investors largely don’t feel comfortable that this is the case. In speaking with them, my impression is that one reason for ESG investor discomfort with Bitcoin is that the CCAF study, “A Deep Dive Into Bitcoin’s Environmental Impact,” reported that Bitcoin uses only 37.6% sustainable energy.

While ESG investors are generally quick to dismiss the work of Bitcoin-critic Alex de Vries — debunked in an earlier Bitcoin Magazine article — I have found they are also more likely to trust the CCAF study over a Bitcoin Mining Council (BMC) study that found Bitcoin uses 58.9% sustainable energy. You can understand why: The Cambridge brand says “reputable, independent research,” while BMC’s says, “industry body.”

Ironically, being an industry body, the very thing that gives BMC access to real-time Bitcoin mining data, also made its findings easier for at least some ESG investors to disqualify. Environmental groups such as Earth Justice and journals such as “The Ecologist” have been similarly quick to assume the CCAF numbers must be the correct ones.

To date, Bitcoiners have had a muted response. The result: The conversation about ESG funds getting behind Bitcoin cannot progress. Bitcoin user adoption stalls.

Meanwhile, environmental groups gain more fuel to lobby governments to regulate Bitcoin mining in a punitive manner.

What Would It Take For ESG Funds To Support Bitcoin?

ESG funds require three things before they will invest in Bitcoin projects. These are the same three things that the White House would need in order to not punitively regulate Bitcoin mining: independent, empirical data demonstrating unambiguously:

- How the CCAF study came to be understated and by how much

- That the Bitcoin macro trend is quantifiably moving toward sustainable energy

- That Bitcoin is quantifiably a net positive to the environment and society

The research presented here is the answer to the first requirement for ESG investors. It won’t by itself open the floodgates for institutional ESG investment, but it does knock over the first major barriers.

Findings

Throughout 2022, I was perplexed about the consistent, 20%-plus difference between the BMC and CCAF estimates of Bitcoin’s sustainable energy use. I saw both the Bitcoin community and environmental groups quote the figure that fit their narratives.

Being in the unusual position of straddling both communities, my simple question was, “Who’s right?”

I decided to research the question.

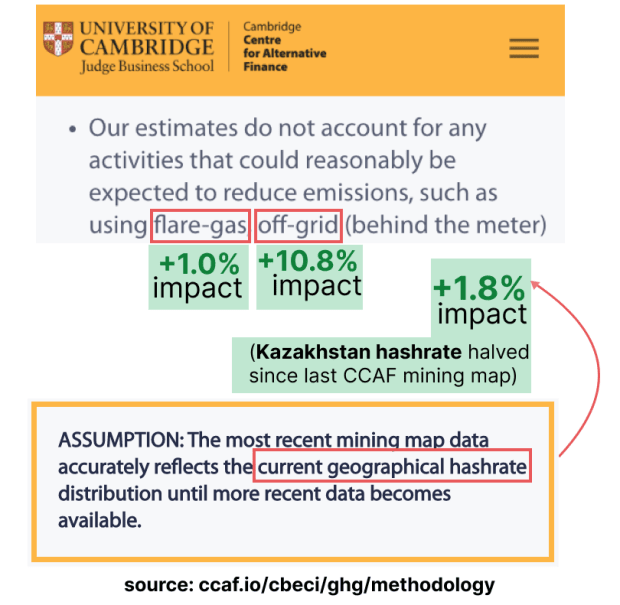

What I realized was that the CCAF model was excluding several factors. No great detective work on my part: It says so on its website under the “Limitations Of The Model” section.

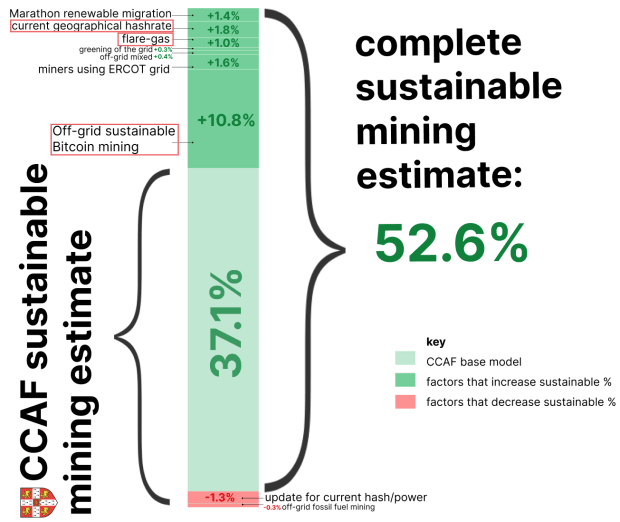

So, I quantified the impact of these exclusions. It turned out that the three exclusions mentioned on its website cause its model to understate Bitcoin’s sustainable energy percentage by 13.6%. This explains two-thirds of the entire variance between the CCAF and the BMC model.

When all exclusions from the CCAF model are factored in, the Bitcoin sustainable energy percentage figure is a full 15.5% higher.

Here’s a full breakdown of all of the CCAF model exclusions. There are nine exclusions in total: seven (in green) that increase the sustainable energy-use figure; two (in red) that decrease it. A full evaluation of each factor and the methodology used to quantify exclusions can be found on my research site.

So, in summary, the CCAF model does not factor in:

- Off-grid mining (impact: plus 10.8%)

- Flare-gas mining (impact: plus 1.0%)

- Updated geographical hash rate (Kazakhstan miner exodus, impact: plus 1.8%)

With all exclusions factored in, the sustainable energy mix calculation is 52.6%. This figure represents a lower-bound estimate, so it is not incompatible with the BMC study showing 58.9% sustainable energy.

How Confident Can We Be That Bitcoin’s Energy Use Is Over 50%?

We can simulate this using the revised model. For Bitcoin’s true sustainable energy use to be below 50%, at least one of the following scenarios would have to be true:

- Four large Bitcoin mining operations secretly run off 100% coal-based energy

- ERCOT (The operator of Texas’s electricity grid) has over-reported its true renewable energy numbers by a factor of four

- Despite the widely-reported exodus of miners from Kazakhstan, its claim on Bitcoin mining actually increased its share of global hash rate from 13.2% to 20%

I would rate the chance of any of these being true as far fetched. As for the likelihood that the true sustainable percentage of the Bitcoin network is 37.6%, there is a higher likelihood of you winning first prize in a single-ticket entry lottery where every man, woman and child in the U.S. has a ticket.

What Does This New Research Mean For Bitcoin’s ESG Narrative

Three things:

1. It won’t stop mainstream media from quoting the Cambridge study or environmental groups from using it. But it will make a difference to how ESG investors look at Bitcoin. For the first time, Bitcoin advocates have a legitimate, data-based way to remove the roadblock that the CCAF study has for some time created in the minds of ESG investors.

Past the first hurdle, proponents of Bitcoin can ask the next two big questions that ESG investors and the White House have: Is Bitcoin’s macro-trend quantifiably moving toward sustainable energy? And is Bitcoin quantifiably a net positive to the environment and society?

2. It also means that previous CCAF findings that appear to have used the same partial data set will need to be revisited. Specifically, we will need to revisit its findings that:

- Bitcoin emissions are currently 58.58 metric tons of carbon dioxide equivalent (MTCO2e) (likely overstated)

- Bitcoin uses less sustainable energy since the China ban (likely to show a different trend once off-grid mining is factored in)

- Emissions intensity may be increasing (for the same reason as the above)

- The major energy used by the Bitcoin network is coal (in light of off-grid data, it is unclear if there is sufficient evidence for this conclusion)

Initial calculations suggest that all four findings may be incorrect. This will need further analysis before we can say this with confidence. I’ll do that in separate pieces of work.

3. To the best of my knowledge, all other major industries are significantly behind Bitcoin in their use of sustainable energy. Bitcoin can legitimately claim to be leading all other industries in its adoption of sustainable energy sources. This is a very strong ESG case, because it shows an industry taking leadership in the renewable transition, which has the potential to inspire other industries by example.

Also noteworthy is that Bitcoin has achieved this feat in the remarkably quick time of just 14 years.

In summary: One of the three hurdles to institutional adoption of Bitcoin on ESG grounds effectively no longer exists. Both Bitcoin advocates and ESG investors can now feel confident that Bitcoin is predominantly sustainable.

Final Words

Throughout the process, I was in contact with both Alexander Neumueller, the digital assets project lead at CCAF, and Michael Saylor, the founder of BMC. Each was both encouraging and supportive of the approach I was taking.

To my knowledge, CCAF was the first to create energy and emission data for the Bitcoin network using a valid methodology and high-integrity data. I use both its energy consumption index (CBECI) and its mining map extensively in my own research and have found both the methodology and the data of these two tools to be sound. It is only the sustainable energy percentages where I found that an underestimation was occurring.

When CCAF first started calculating the sustainable energy use of the Bitcoin network in late 2019, it was highly accurate. It is the subsequent proliferation of largely renewable-based, off-grid mining, flare-gas mining and rapid miner movement from Kazakhstan and to Texas that saw its model start to lose tune. As any quant-trader can tell you, “even a great algorithm will lose tune over time.”

This is a guest post by Daniel Batten. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo