[ad_1]

On-chain data shows the Bitcoin Spent Output Profit Ratio (SOPR) has bounced back into the profit zone with the latest rally above $30,000.

Bitcoin SOPR Has Successfully Retested 1.0 Support Line

According to data from the on-chain analytics firm Glassnode, investors are now selling their coins at a profit. The “SOPR” is an indicator that tells us whether profit-taking or loss-taking is dominant in the Bitcoin market currently.

When the value of this metric is greater than 1.0, it means that the profits being realized by the investors are higher than the losses currently. On the other hand, the values of the indicator under this mark suggest the market as a whole is moving/selling coins at a loss.

The SOPR being exactly equal to 1.0 naturally suggests that the average investor is just breaking even on their selling at the moment, as the total amount of profits being harvested in the market is equal to the losses.

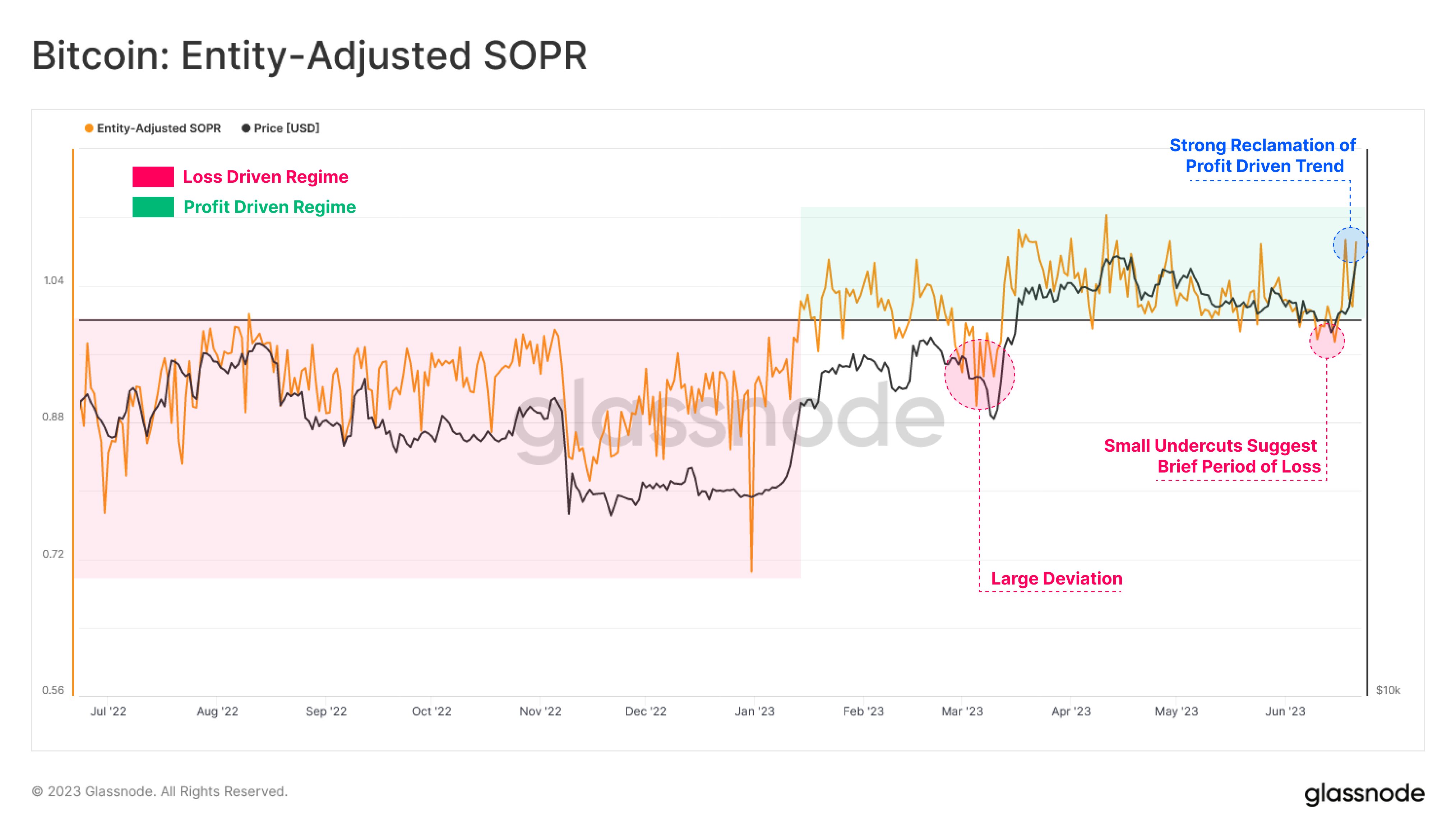

Now, here is a chart that shows the trend in the Bitcoin SOPR over the past year:

Looks like the value of the metric seems to have shot up in recent days | Source: Glassnode on Twitter

Note that the version of the SOPR being used here is the “entity-adjusted” one, meaning that it only takes into account the transactions made between separate entities on the network and not all individual wallets.

An “entity” here refers to a single address or a collection of addresses that Glassnode has determined to belong to the same investor. As transfers where a holder moves coins to a different wallet of theirs aren’t actually sales at all, they aren’t relevant to the SOPR, and so, removing them from the data makes the indicator more accurate.

As you can see in the above graph, the entity-adjusted SOPR has been mostly at values above 1.0 during the last few months, a trend that makes sense as the asset has observed a rally in this period, which is bound to have put investors into notable profits.

Back in March, however, the indicator had deviated away from this profit-taking trend, as the Bitcoin price had taken a significant hit. This deviation didn’t last for too long, though, as the metric returned to values above 1.0 as the rally resumed.

Historically, the transition line between these two zones, that is, the 1.0 level, has had an interesting relationship with the price. During bearish trends, this line has proved to be a resistance point for the coin, while in bullish trends, it has often acted as support.

Recently, as Bitcoin had been struggling, the SOPR had observed a slight drop under the 1.0 level again, although the deviation was pretty small when compared to the instance in March.

As it has happened many times in the past, it would appear that the 1.0 retest has provided a bounce to BTC this time as well, as the cryptocurrency has rallied towards the $30,000 mark.

The Bitcoin SOPR has surged above 1.0 with this rebound, implying that the investors are now once again harvesting a large amount of profits.

BTC Price

At the time of writing, Bitcoin is trading around $30,100, up 17% in the last week.

BTC has slowed down since the sharp jump | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo