[ad_1]

The Bitcoin market may be close to a decision point as on-chain data shows the Adjusted Spent Output Profit Ratio (aSOPR) is retesting the 1.0 level.

Bitcoin aSOPR Has Declined Towards A Value Of 1.0 Recently

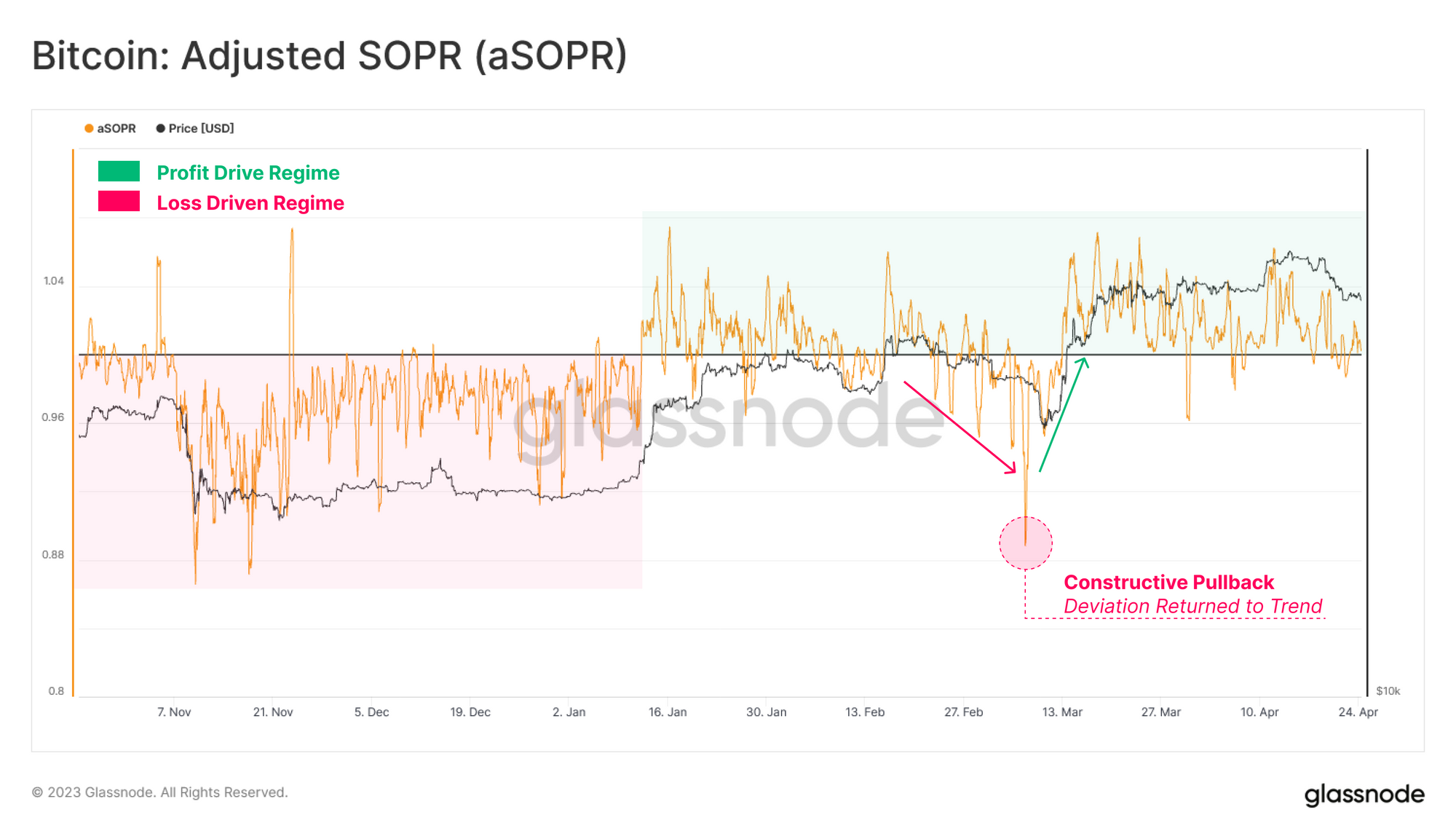

According to the latest weekly report from Glassnode, the BTC market had shifted towards a profit-dominated regime back in January. The “aSOPR” is an indicator that tells us whether the average investor is selling their Bitcoin at a profit or at a loss currently.

The “adjusted” in aSOPR comes from the fact that this metric has been adjusted for filtering out transactions/sales of all coins that were done within only one hour of the previous transaction/purchase. The benefit of making this restriction is that it removes all noise from the data that wouldn’t have had any noticeable implications for the market.

When the value of this indicator is greater than 1.0, it means the total amount of profits being harvested by the investors is more than the losses right now. On the other hand, values of the metric below the threshold suggest the market as a whole is realizing some losses at the moment.

The 1.0 level itself naturally serves as the break-even mark, where the total amount of profits becomes equal to the losses.

Now, here is a chart that shows the trend in the Bitcoin aSOPR over the last few months:

The value of the metric seems to have been above the 1.0 mark in recent days | Source: Glassnode's The Week Onchain - Week 17, 2023

Historically, the aSOPR 1.0 level has been quite important for Bitcoin, as it has represented the mark where the transition between bullish and bearish trends has taken place.

During bear markets, the indicator generally stays under this level, as investors naturally realize large losses. The mark acts as resistance in such market conditions, meaning that any attempts to break above it usually end up in failure.

On the contrary, the 1.0 level acts as a support for the price during bullish periods, making sure that the indicator stays in the profits zone. Both these patterns can also be seen in action in the above graph, as the 2022 bear market saw the metric being stuck in the zone below 1.0, while the rally that started in January has observed it is in the green area.

There was an exception last month, however, when the Bitcoin aSOPR sharply plunged below the 1.0 mark due to a sharp plunge in the price. It wasn’t long, though, before the metric (and also the price) returned back toward the bullish trend, implying that it was only a temporary anomaly.

Recently, as the asset’s price has once again been going down, the indicator has also declined toward the 1.0 level. “With aSOPR currently retesting the break-even level of 1.0, this puts the market close to a decision point,” explains Glassnode.

It now remains to be seen whether the retest will be successful, and this level will act as support for the price, or if a break below will take place, possibly bringing with it more decline for the cryptocurrency.

BTC Price

At the time of writing, Bitcoin is trading around $27,300, down 10% in the last week.

BTC has seen some sharp decline recently | Source: BTCUSD on TradingView

Featured image from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo