[ad_1]

I write this article as a resident of New York City, home of the Statue of Liberty, one of the most widely recognized symbols of America — the “land of the free”.

But, when it comes to Bitcoin, I don’t feel so free as a New Yorker.

New York State (NYS) is one of the most restrictive jurisdictions in the world in regard to Bitcoin. Since 2015, NYS has required companies that deal in the virtual currency marketplace to obtain a “BitLicense” in order to do business in the state. This license is both difficult and expensive to acquire. Bitcoin-only exchanges like River and Swan as well as long-standing, reputable crypto exchanges like Kraken cannot serve residents of NYS because they do not have BitLicenses (for Swan, some NYS residents are grandfathered in from a time when Swan was permitted to operate in NYS, but the exchange is no longer allowed to enroll new New York residents). And Strike, a bitcoin payment app, as well as Ledn, a bitcoin borrowing and lending platform, are not permitted to serve NYS residents either.

As if the BitLicense wasn’t an offensive enough roadblock in the state that is home to New York City — often purported to be the financial hub of the world — NYS’s current governor, Kathy Hochul, has pushed to make NYS even more unfriendly to Bitcoin. In November 2022, she signed a law banning Bitcoin mining companies that don’t use 100% renewable resources from operating in the state for two years.

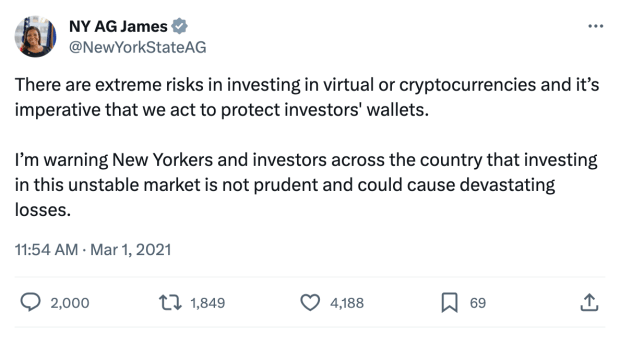

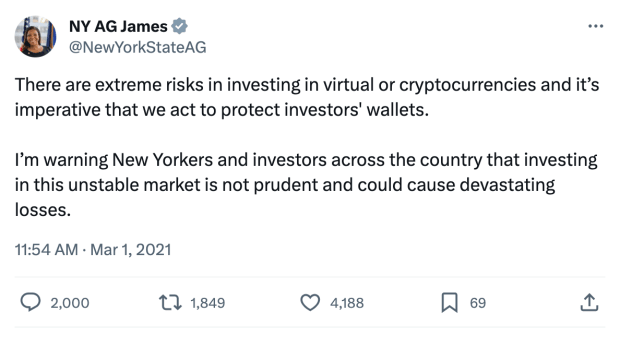

To drive home the point about New York’s stance on Bitcoin, look no further than the words of the state’s Attorney General, Letitia James.

(At the very least, she could have differentiated between bitcoin and all other digital assets.)

NYS authorities seem to be doing everything in their power to protect the old financial guard — Wall Street — pushing Bitcoin-related exchanges and start-ups out of NYS.

To say it’s disappointing to be a Bitcoin enthusiast living in New York is an understatement.

I feel inspired and hopeful, though, when I look beyond the state lines of New York, and even beyond the borders of the United States, to Africa, where the youth are passionate about promoting greater Bitcoin adoption.

On my podcast, new renaissance capital, I interview Bitcoin educators, entrepreneurs and thought leaders mostly based in The Global South.

Whenever I speak with guests from Africa, I get the feeling that they’re willing to push for greater Bitcoin adoption in their country (and on the continent at large) — whether their government is currently open to the idea or not.

Africans in particular have a certain sense of stoicism in their approach to Bitcoin. They’re on a mission to further the adoption of what Alex Gladstein termed “post-colonial money” in his book Check Your Financial Privilege: Inside the Global Bitcoin Revolution.

So, in this piece, I’d like to highlight some key segments of conversations I’ve had with African Bitcoiners, people who I believe future generations will look back at and thank for the work they’re doing now to make Africans freer and more self-sovereign.

Let’s start at the southwest tip of the continent.

Namibia

Nikolai “OKIN” Tjongarero, founder of EasySats, a company that makes it easy and cheap for Namibians to acquire bitcoin, has been doing his part to convince the powers that be in Namibia of Bitcoin’s value. He’s even orange-pilled members of the Bank of Namibia, the country’s central bank.

When higher-ups at the bank reached out to a burger joint that OKIN had recently convinced to accept bitcoin as a form of payment and requested to meet with OKIN at the restaurant, OKIN happily (though with a bit of trepidation) obliged.

“I don’t think they were there to try to catch anybody,” says OKIN of the 15 central bankers that showed up to the meeting. “They were like ‘Show us how we can buy burgers [with bitcoin].’”

After learning that most of the bankers didn’t know the difference between a custodial wallet and a non-custodial wallet, OKIN taught them how to transfer their bitcoin from their Coinbase exchange wallet to a Muun Wallet. Once the bankers were set up with Muun, they went to town and spent over 6,000 Namibian dollars (US$323) worth of bitcoin on burgers and beers before the meeting was through.

“This was just to see how they could spend their bitcoin,” states OKIN, who added that most of them “didn’t know what [they] could do with this thing (Bitcoin)… People are telling [them] that [they] can’t do anything with it, [that] it’s just magic internet money.”

But after that encounter with OKIN, their perspective had begun to shift, and they actually consulted OKIN for their research on Central Bank Digital Currencies (CBDC). To highlight the risks of surveillance and centralized control associated with CBDCs, OKIN pointed to the failure of the eNaira, a CBDC in Nigeria, the first African country to launch one. He pointed out in his commentary to the central bank that only 1% of Nigerians were using the eNaira while 50% were using some form of cryptocurrency, mainly bitcoin.

Having spent some time in Namibia myself, this story wasn’t so surprising. During my time in the country, I noticed how accessible both high-ranking members of institutions and politicians were. When I suggested that the accessibility of authorities in the country might be a plus when it comes to Bitcoin getting its fair shot in Namibia, OKIN agreed.

“Everybody’s a person; a politician is still a person,” says OKIN. “It’s not like [these] people are behind a walled garden — not in Namibia.”

While the Namibian authorities are considering greater Bitcoin adoption, everyday Namibians remain free to use it at their own risk, to pay for goods and services with it if they so please.

Now, let’s go next door — to South Africa — to see how Bitcoin is improving lives in the country.

South Africa

Luthando Ndabambi, a leader in the Bitcoin Ekasi community, is living proof of how bitcoin is beginning to break South Africans free from the shackles of poverty.

“Bitcoin changed[d] my life,” shares Ndabambi, a Black South African born into apartheid. “I was living [in] a shack where [when] it’s raining, I had to move [my] bed at night because the rain was getting inside the shack. But my life now has really changed because I’m living [in] a proper house now — because of Bitcoin.”

Not only has saving in bitcoin allowed Ndabambi to upgrade his physical living conditions, but it altered his behavior for the better, as well.

“I was drinking a lot; I was not thinking about [the] future,” explains Ndabambi. “After I [began] working for Bitcoin Ekasi, my life change[d] completely. I’m thinking different[ly] than before. I don’t care about parties. I just focus on my girlfriend and my son, and my family, as well. But I don’t care about other thing[s] like wasting my money. I always think, ‘If I go to the club, I’m going to eat (spend) a lot of money… No, do not go just to waste money.’ I have to use my money [for] something that’s going to change my life a lot.”

Ndabambi is the embodiment of the idea that “Bitcoin is hope”. And this sort of hope is rare to find in Black South Africans who grew up in townships both during and post-apartheid according to Hermann Vivier, founder of Bitcoin Ekasi and Bitcoin Magazine contributor.

When I met Vivier in New York City and took a ferry with him from the southern tip of Manhattan to the small island on which the Statue of Liberty is located, Vivier explained to me that apartheid did much more damage to non-white South Africans than can be measured. “It was designed to break spirits and to instill hopelessness,” says Vivier.

He then explained to me how Ndabambi has become a model for those in his community, as Ndabambi has worked hard to complete tasks and assume responsibilities that he otherwise might not have if he didn’t truly believe that the future could be brighter — in large part because of Bitcoin.

Now, let’s head over to West Africa to hear from a Ghanaian who’s doing everything in his power to usher in a brighter future for Ghana with Bitcoin.

Ghana

Kumi Nkansah, journalist by trade and founder of the Bitcoin educational group the Bitcoin Cowries, has been doing his part to orange-pill not only as many everyday Ghanians as possible but also members of the Ghanaian government.

“I got called into a very high-ranking office in the government to come and talk about Bitcoin,” shares Nkansah. “This is what they said to me: Keep on — learn as much as you can. Once we are ready, we’ll call you again [and] you will come and help us make certain decisions when it comes to Bitcoin. We like what you’re doing. Keep up with it.”

Nkansah explained that politicians in Ghana are open to the idea of Bitcoin because “they can feel the inflation; they can feel how they are losing money (purchasing power), so they are trying to find alternatives.”

His interaction with a member of parliament (MoP) was particularly inspiring.

“I got called by one member of parliament,” starts Nkansah. “His sibling actually came for the Trezor Academy (an event Kumi hosted), and I gave him a hardware wallet. So, he took the hardware wallet and showed [it] to this member of parliament. And then I got called to explain what it is and how they can use it.”

According to Nkansah, here’s how the conversation between him and this member of parliament went:

Nkansah: “Sir, did you know next year is the election year in the US?”

MoP: “Yes.”

Nkansah: “Did you know three of the presidential candidates are accepting bitcoin payments [for donations for their campaigns]?”

MoP: “Really?!”

Nkansah: “Yes, they are. Where do we borrow money from? Is it not the US? So, if these guys who want to be president are telling US citizens how they’re going to use Bitcoin to transform the economy and we are not learning more, and at the end of the day we’re going to borrow money from these same people, what are we doing to ourselves? We better start learning about Bitcoin.”

MoP: “Hey, gentleman, you have just shocked me. I’m going to learn more about this — but you have to learn more so that when the time comes, you will teach us what we have to do.”

Nkansah went on to explain how while some members of the Ghanaian government attended the first African Bitcoin Conference, which took place in Ghana last year, even more will attend this year in efforts to keep learning. And this education is sorely needed as Ghana is being pressured by the IMF to implement a CBDC.

“One of the IMF’s conditions is for governments to leverage on CBDCs,” explains Nkansah. “But if they (Ghanaian government officials) should come and learn about the real difference between Bitcoin and CBDCs, they would actually figure out the best way to go about it — rather than doing what the IMF is saying.”

We can only hope that the powers that be in Ghana continue to follow Nkansah’s lead.

Now, let’s head over to East Africa to hear from someone else who has the ear of members of their government.

Ethiopia

Kal Kassa, founder of Bitcoin Birr, an open-sourced Bitcoin educational platform and Bitcoin Magazine contributor, is a native Ethiopian with American citizenship who has received permission from the Ethiopian government to educate the country’s citizens about Bitcoin — despite the fact that it’s technically illegal to hold the asset within the country’s borders.

“Members of the government on an individual basis have been helpful in terms of giving me some sort of platform, giving me the ability to speak to audiences,” explains Kassa. “We have a defragmented or decentralized way of governing, so if you were to ask 15 ministers [about Bitcoin], you’re going to get 15 different responses. It’s not going to come from the institution or the agency or the office, but it’s going to come from that individual — and I’m sure they’re holding it (bitcoin) on their private books. There has been some good progress, but just nothing on an official basis.”

Kassa went on to discuss how people who hold and use bitcoin do so in a legal grey area, which sounded less ominous than what he wrote in an article he penned for Bitcoin Magazine entitled “The Marathon: Ethiopia and Bitcoin”.

“Even as regulators and lawmen use sticks of persuasion, citizens boldly send and stack sats,” wrote Kassa. “If you thought laser-eyed fund managers in the West were bullish, you haven’t met 23 year-old Ethiopian freelancers who run completely digitized projects (from procurement to contracting and invoicing) using applications and Layer 2 open-source Lightning wallets. Humble as these transactions may be, these kids are taking a large risk to fulfill their basic rights of untampered money and sovereign value.”

But based on what Kassa is saying now combined with the fact that, according to Kassa, no one in the country has been prosecuted for using or holding bitcoin, it doesn’t seem that Ethiopian Bitcoiners have much to fear.

Kassa explained that because there’s been no prosecution for using Bitcoin and therefore no legal precedent set, most are simply following what the National Bank of Ethiopia has stated, which is that Bitcoin isn’t legal tender and that any losses sustained while using the asset are beyond what the bank can cover.

The situation is similar within the borders of Ethiopia’s next door neighbor, Kenya.

Kenya

Master Guantai, founder of Bitcoin Mtaani, a platform that educates Kenyans about Bitcoin in multiple African national languages, explains that Kenyans are essentially free to use Bitcoin at their own risk, as per the Central Bank of Kenya.

“In Kenya, [according to the] government and central bank, Bitcoin is not a currency,” states Master Guantai, who also added that the messaging from Kenyan authorities around bitcoin is “use it at your own risk; do your own thing.”

He did add, though, that further legislation around Bitcoin is likely on the way but that there’s little chance it would hinder adoption.

“Basically, all African countries are just waiting for America to pass a law and then they’ll copy paste [it] with some edits,” he explains. “So, the American [law] or the European [law] — whoever does it first — will [create] the template, which will set the tone of how harsh or how lenient the Kenyan government [will be].”

When I asked Master Guantai if he was worried that the Kenyan government might adopt bad or anti-Bitcoin legislation from the United States, he responded with a clear “No”.

“Kenyans, we have our way of making our government listen to us even if by force — especially on Twitter,” he explains. “Kenyans on Twitter are no joke at all. If something is not in good taste or whatever, it [gets] blown out of proportion to the extent that even our own president cannot ignore it. He has to address it when it becomes a whole thing. The government’s primary objective is to look out for the youth. The government does not want to hear the youth saying ‘You’re bringing this legislation which is negative and we already don’t have jobs [even though] we are educated; it’s like you’re blocking us from opportunities left, right and center.’ With that in mind, I can say I’m not worried.”

Marcel Lorraine, founder of Bitcoin Dada, an organization that educates African women about Bitcoin, doesn’t seem worried either, especially since Kenya is such a tech-friendly country.

“Kenya has established itself as a pro-technology nation, earning the nickname ‘Silicon Savannah’ for its vibrant tech ecosystem,” shares Lorraine. “The country’s government has actively promoted technology adoption through initiatives like mobile money pioneer M-Pesa, digital literacy programs, and e-government services. Kenya boasts a burgeoning startup scene, tech hubs, and research institutions, fostering innovation and entrepreneurship.”

Lorraine explains that especially because of Kenya’s work in implementing M-Pesa, a mobile money service created to increase financial inclusion in Kenya and other African nations, it should be open to the idea of Bitcoin.

“Kenya’s leadership in peer-to-peer (P2P) transactions through technologies like M-Pesa offers an interesting connection to cryptocurrencies,” explains Lorraine. “Some Kenyan individuals and businesses have started exploring cryptocurrencies [like bitcoin] as an alternative to traditional financial services, particularly for cross-border transactions and as a store of value.”

After hearing these words from Master Guantai and Marcel Lorraine, it’s hard to imagine the Kenyan government or central bank wanting to cut off everyday Kenyans from the type of empowerment and financial autonomy that Bitcoin offers.

Let’s make one last stop in East Africa before we wrap this up.

Tanzania

While the Bank of Tanzania, the country’s central bank, issued a one-page statement in 2019 about the dangers of cryptocurrencies and the fact that they aren’t considered legal tender in Tanzania, this hasn’t stopped trailblazers like Man Like Kweks from promoting greater Bitcoin adoption in the country.

Man Like Kweks, a teacher by trade and a musician, recently summitted Mount Kilimanjaro with the help of the over 5 million Sats he raised via Geyser Fund in efforts to bring attention to and raise funds for his new Bitcoin education program: POWA (Proof of Work Academy).

“There’s been many different projects that have been funded by bitcoin, [and] I want[ed] to put Tanzania on the map,” explains Man Like Kweks. “I was just very blessed that my network in the Bitcoin and Nostr community was enough to get enough traction to climb it (Mount Kilimanjaro).”

And as for the inspiration behind the name of his academy:

“In Swahili, a greeting is ‘mambo’ and then the response is ‘powa’, [which means] ‘things are cool’,” he explains. “[POWA] is targeting the youth. Linking it with ‘Proof of Work’, I just wanted to do something cool and something fresh, and calling it an academy, it all just kinda worked.”

It definitely did work, and things will likely continue to be very cool for the Tanzanian youth if they can follow Man Like Kweks’ lead and leverage the global Bitcoin community to help elevate their creative efforts.

Handing Africa The Torch

So, now you might have a better idea of why I’m a bit envious of what I see happening in certain African jurisdictions compared to the one in which I live.

While New York continues to be inhospitable to Bitcoin companies, Africans are taking the bull by the horns and forging ahead fearlessly, working to create a future buoyed by a network on which users can transact permissionlessly with the hardest asset humanity has ever known.

If Lady Liberty could, I’m sure she’d reach across the Atlantic and hand Africans her torch, asking them to run with it, because the words of Kal Kassa — “Ethiopia, we’re a country of poor, young masses. Give them a computer and some objective and we’ll get there” — sound a lot more like the words printed at Her base — “Give me your tired, your poor, your huddled masses yearning to breathe free” — than the words of authorities in New York, or the US more broadly.

Godspeed, Africa, and I’ll see you at the African Bitcoin Conference in Ghana in December.

This is a guest post by Frank Corva. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo