[ad_1]

Tether (USDT) has continued to move into exchanges recently. Here’s why this can be a positive development for Bitcoin.

Tether Supply On Exchanges Is Now Highest In 7 Months

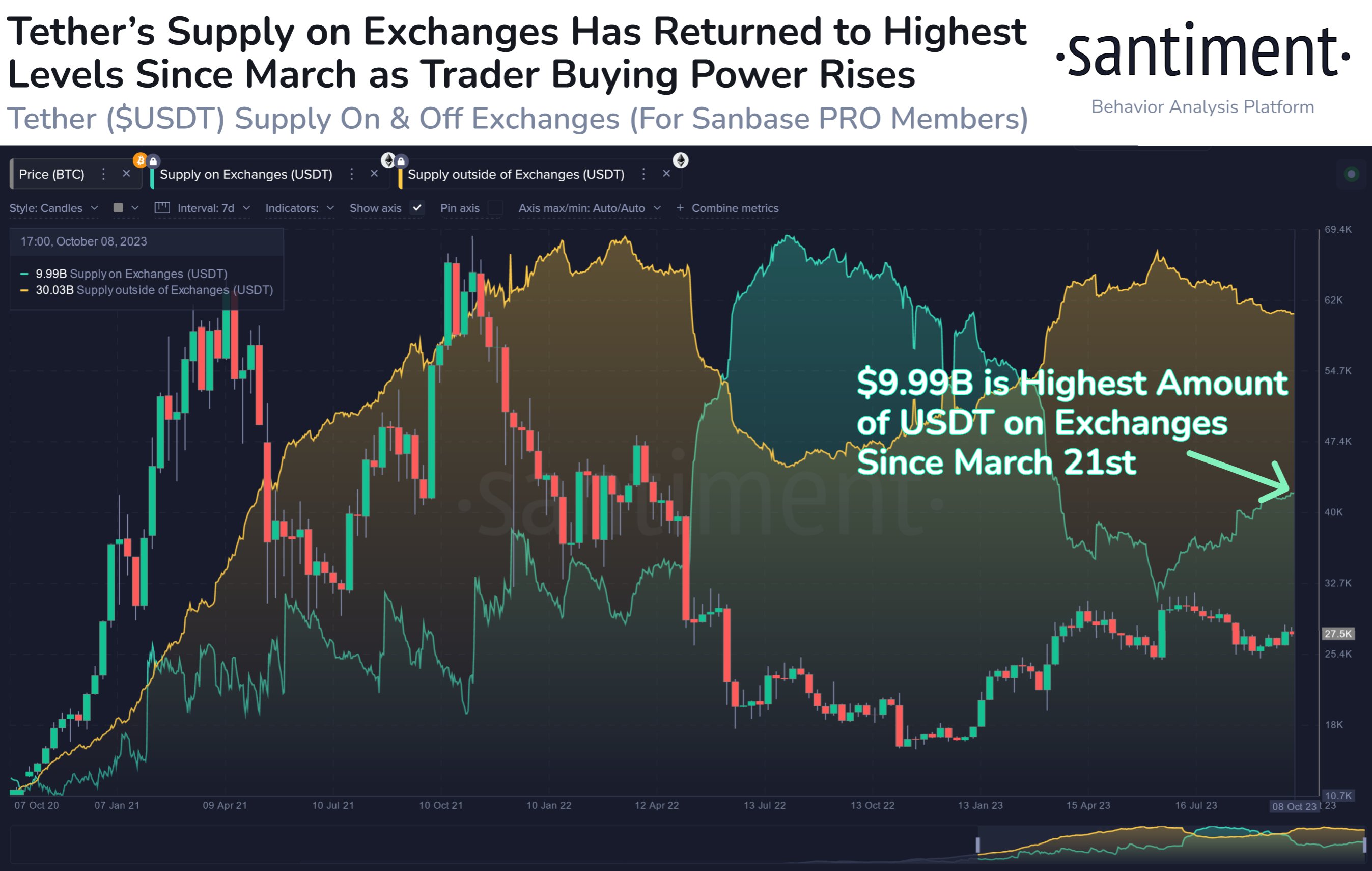

According to data from the on-chain analytics firm Santiment, $9.99 billion worth of USDT is now on exchanges. The indicator of relevance here is the “supply on exchanges,” which keeps track of the total amount of a cryptocurrency being stored in all centralized exchanges’ wallets.

The interpretation of this metric can differ depending on the type of asset that’s being discussed. In the case of Bitcoin, for example, the exchange reserve may be considered a measure of the potential selling pressure, as one of the reasons investors may deposit the coin is for selling-related purposes.

Thus, the cryptocurrency’s supply on exchanges going up could be a sign that selling is increasing in the sector, and hence, the asset’s price may be heading towards a bearish outcome.

In the context of the current discussion, BTC’s supply on exchanges isn’t the one of interest, but rather the metric for Tether is. USDT is a popular stablecoin (the largest one based on market cap) that always has its value pegged to the US Dollar.

Here is a chart that shows the trend in the supply of exchanges for Tether over the past few years:

Looks like the value of the metric has been going up in recent days | Source: Santiment on X

Usually, an investor may want to hold their capital as a stablecoin like USDT to keep it away from the volatility associated with other assets in the cryptocurrency sector.

However, many such stablecoin holders use these assets as a temporary safe haven, as they eventually wish to return to the volatile market.

When these investors finally find the time to jump back into cryptocurrencies like Bitcoin, they swap their USDT for them. These traders may use exchanges to make this shift, so a rise in the supply on exchanges of the stablecoin can be a sign that investors are looking to swap into volatile coins.

Such buying using Tether can naturally cause a bullish effect on the prices of BTC and others. So, in this way, the exchange supply of the stablecoin can be considered the opposite of the metric for BTC.

The above graph shows that the indicator’s value has increased in the last few weeks. “The $9.99B worth of Tether sitting on exchanges is the highest level of buying power for crypto’s top stablecoin in approximately seven months,” notes Santiment.

It should be kept in mind that the rise in the Tether supply on exchanges only implies an increase in the available dry powder. Whether Bitcoin would benefit from a boost depends on whether this dry powder is used to buy the asset or not.

BTC Price

Bitcoin has declined in the past couple of days as the asset now trades around the $27,600 level.

BTC has recovered a bit from its lows from yesterday | Source: BTCUSD on TradingView

Featured image from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Santiment.net

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo