[ad_1]

This is an opinion editorial by Enza Coin, a Bitcoin-focused investor and content creator.

Of all countries on Earth, the formerly-named Yugoslavia best reflects all of the prime examples of what Bitcoin “fixes.”

I was born there — grew up, started school and even had my first job there before moving abroad. Now, I have realized that my experiences in Yugoslavia from childhood to adulthood formed my views of the world, its geo-political powers, the value of money or lack thereof, economics and corruption. The events in Lebanon over the last number of years, with the collapse of the economy, are similar to the things that I experienced in the former Yugoslavia decades earlier. No other country in Eastern Europe or even the former Soviet Union experienced the atrocities of what has happened in Yugoslavia. And, as a result, it can be called the poster child for Bitcoin’s adoption.

Yugoslavia, The Poster Child For Bitcoin Adoption

Modern Yugoslavia (technically the “Socialist Federal Republic of Yugoslavia”) was formed after World War II and made up of the crumbled Kingdom of Yugoslavia, where wealth had been pilfered from the people by the royal family, which fled into exile. You know, an “exile” where the masses are left to manage on their own while those who left live in luxury.

The atrocities committed by the German invaders during the war added to the downfall of the former kingdom. Unfortunately, this resulted in the loss of my grandmother and aunt at an internment camp. Fortunately, my father survived by luck, hiding in nearby forests as a mere 5-year-old child.

These events left the country open to the rise of socialism. It was to be a haven for the people, with socialist rights and support for all. For many years, it did function in this way. It was one of the wealthiest of the “Communist block” countries with a standard of living that was high and even matched some regions in Western Europe. Healthcare was good and free, and I saw that education was top notch. Tourists from Western Europe flocked to the country yearly, particularly to the beautiful coastline of the Adriatic Sea each summer. People could travel freely, unlike in other Eastern European countries and the USSR. I recall that one could watch Western television and listen to the radio. You could buy Western newspapers and magazines.

These privileges weren’t allowed in the other parts of the so-called “Iron Curtain.” In fact, Yugoslavia was not part of the Iron Curtain or under the control of the USSR, thanks to the rule of Josip Broz, founder of the Non-Aligned Movement.

The year 1980 saw the beginning of the end of the country, with the death of Broz. For good or bad, he held the diverse group of people living there together. His death sparked the rise of nationalism and what we now coin as debt or “printing-press” economics. The true end came in 1990, which saw the start of the wars of independence, ultimately turning one country into seven.This history also inadvertently sparked my Bitcoin learning cycle.

Learning The Benefits Of Real Money The Hard Way

My experiences in Yugoslavia were key factors through my formative years that led me into my first investment in bitcoin.

I realized what real money is having lived with Yugoslavia’s famed hyperinflation in the early 1990s. Steve Hanke called this “The World’s Greatest Unreported Hyperinflation.”

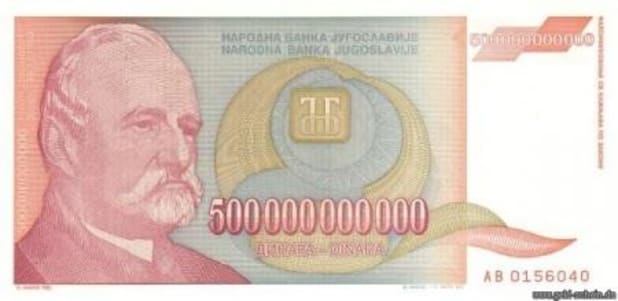

Inflation peaked at 313,000,000% per month, or 116,000,000,000% per year. The National Bank of Yugoslavia started printing a 500 billion dinar note. I recall my father giving me a stack of dinar paper notes to play with as a child and telling me to simply crumple them into a big ball and practice some basketball shots with my brother, an aspiring basketball player (who is now 6’ 8” and does play). This seemed strange to me at the time, but my father explained that the government had printed so much that the money was worthless. He said that money shouldn’t be created on the whim of the government to use it for its abuses. I guess this taught me what real money needs to be… Bitcoin.

Money Should Have A Limited Supply

Before the central bank printing press inflation really kicked in, my father lent a neighbor 1 million dinar to help him buy some land in 1990. The agreement was to repay it within a couple of years. However, in a not-so-neighborly response, the neighbor did repay the loan plus interest, but chose to do so after major, inflation-induced devaluations of the dinar through 1993. My father said that the million dinar was not even worth enough to buy an orange. Oddly, he really did refer to an orange. Perhaps this was a foreboding that someday I would be orange pilled.

Money Should Be Immune To Seizure

As with everyone in the fiat world, you needed a bank account to live in Yugoslavia. But it was a running joke within the country that everyone’s main hobby was to open bank accounts outside of the country, in places like Austria, Germany and Switzerland.

Earnings from jobs outside of the country were kept in foreign banks and any money earned locally was converted into Deutsch marks, Austrian schillings and Swiss francs as quickly as possible. Regardless, we still needed to hold some money in local banks. This money was lost to eternity, due not only to deposits being frozen by the government, but also due to complications from the breakup of Yugoslavia (which included splitting up its banks).

The breakup led to fights over succession of the country’s assets and liabilities by the newly-independent countries and the dissolution of legacy institutions. Legal fights over obligations and their legal successors are still being fought today.

Similarly, I recall the day that my father was to go to the bank with an intention to withdraw all his remaining savings. He became busy with another task and said that he would go the next day. Unluckily, the next morning, it was announced that all deposits were frozen. One day of inadvertent procrastination cost a small bundle. This taught me to not only get things done quickly, but to ensure that I diversify my wealth. This is why I find Bitcoin’s self sovereignty to be one of its most desirable advantages.

Bitcoin Promotes Peace And Freedom

They say that if Bitcoin were adopted by more countries, it could help stop wars inspired by fiat-printing-press-funded governments that are incentivized to support military-industrial complexes and self-serving policies of politicians.

I wish that Bitcoin would have been created 20 years earlier and adopted by Yugoslavia. Perhaps this could have prevented the wars and the breakup of the country. Some 140,000 people’s lives might have been saved.

My memories of the sights and sounds of the war are vivid, from recollections of explosions shaking the windows of my family’s home to cancellations of school. On top of this, the U.S. and other NATO countries believed that they had the moral standing to sanction and embargo all of the countries of the former Yugoslavia. Sanctions, inspired by fiat printing presses and the military-industrial complex, simply led to us standing in lines to buy certain foods, the absence of some medications and even seeing NATO planes dropping bombs overhead. Sanctions impact the masses, not the elites who flee with their pockets full of fiat. Fortunately, for the rest of us, now there is Bitcoin.

Bitcoin Supports A Better Future

What I experienced growing up stays with me today and partly drives my motivations in life and my move to Bitcoin. When I first learned about Bitcoin and saw how it could help promote democracy and economic stability, I realized that its game-changing technology is a way for the 99% to fight back against tyranny.

My investment today in bitcoin means more to me than just having financial security. In some way, I feel that with each sat I buy, I can help the world work to a better future, avoiding the sorrows and mistakes of the past like those experienced in the former Yugoslavia. Remember what George Orwell wrote in his book “1984”: “We shall meet in the place where there is no darkness.” To which I will add that a place in the light is the world of Bitcoin.

This is a guest post by Enza Coin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo