[ad_1]

In regions where the internet is slow or unstable, using Bitcoin’s Lightning Network can be a challenge. What are the best tools available?

This is an opinion editorial by Anita Posch, the founder of Bitcoin For Fairness who has traveled around the world to learn how the globally unbanked can benefit from sovereign money.

In my work as a Bitcoin educator, I help interested people to take their first steps into the space and gain an understanding of why Bitcoin is important for them personally and for the world at large. I also help Bitcoin community builders to become educators and share their knowledge with their peers. My focus lies on financial sovereignty, which can only be achieved by holding bitcoin in self custody and using additional tools to reach a decent level of privacy.

To find out if it is time to onboard people onto a non-custodial Lightning wallet, even in difficult settings, I set out to do a Lightning wallet test in rural Zimbabwe with low and erratic internet connectivity on mobile data. I’m not talking about Bitcoin on-chain wallets: There is really no need at all to use a custodial Bitcoin wallet. I’m talking about Lightning wallets here, non-custodial ones.

The Resistance To Change A Habit

Over and over, I hear and read statements saying that newbies need convenient, easy-to-use tools, otherwise they would be overwhelmed and won’t use Bitcoin. I think this is wrong. People who are being onboarded onto custodial services are harder to convince to step up their game toward financial sovereignty and start using non-custodial tools. There is a big resistance to change habits. If a person starts using a custodial wallet, they very, very often believe that they are using Bitcoin already. They will tell you that they never faced any problems and that they, therefore, don’t see a need to change their setup.

As a Bitcoin educator, it is my first duty to teach people about self custody, why it is important and to make them aware of the risks they are taking. They need to understand the difference between custodial and non-custodial services. Only then do I present different tools and make them familiar with the pros and cons of each one. Afterwards, they need to decide for themselves which route they want to take. That is the only way that people won’t consider me responsible for any losses they might incur and it’s the only way that they will understand that Bitcoin is all about ownership. If you’re using a custodial service, you’re not financially sovereign. You’re a pre-coiner, with one foot still in the old world and you can be rug pulled at any time. I think most people have already forgotten about Mt. Gox and even FTX. Fast money, fast access to (a false belief that you’re really using) bitcoin, fast loss.

When we set out to show our friends how to use Bitcoin in the first place, why do we rush the onboarding by using convenient tools? Why not take a little more time and do some groundwork beforehand. It is almost the same effort for an educator to introduce a custodial wallet in comparison to a non-custodial wallet. I think showing a custodial wallet first is not even done for the convenience of the newbie, it is rather done for the convenience of the educator. More convenience, less explanation needed. That’s short sighted.

I’m convinced that everyone who is using Bitcoin today will need to change wallets and services in the future. Development is fast; I estimate that I’ve been using around 15 different wallets in my Bitcoin journey so far. More to come. People need to know this, too. It is not realistic to expect that you’ll be using the same wallet now and for the next 20 years, like you might do with your bank account (if you have one).

I feel a big discomfort when people are rushed into using custodial wallets, receiving a few satoshis and then they are sent off, all for the sake of fast adoption. I did it once, too. I helped someone install Wallet of Satoshi and I regretted it later. Up until now, I recommended using Blue Wallet on the BFF Bitcoin flyer, mainly because of its ease of use and the possibility to have a Bitcoin and Lightning wallet in one app. I was aware of the downside, the custodial Lightning wallet, but I thought that non-custodial Lightning node wallets like Breez or Phoenix wouldn’t work reliably in areas with slow or bad internet connectivity.

Goal: Identifying A Non-Custodial Lightning Wallet That Works In Areas With Low Internet Speed

I have been asking myself over the last couple of months if it wouldn’t be better to recommend a non-custodial Lightning wallet. I was unsure, though, if Phoenix or Breez would work in a setting with bad internet connectivity. That’s why I set out to do a test in the area of Great Zimbabwe, about 300 kilometers south of the Zimbabwean capital of Harare. I wrote a separate article about the impressive historical importance of Great Zimbabwe.

Test Setting

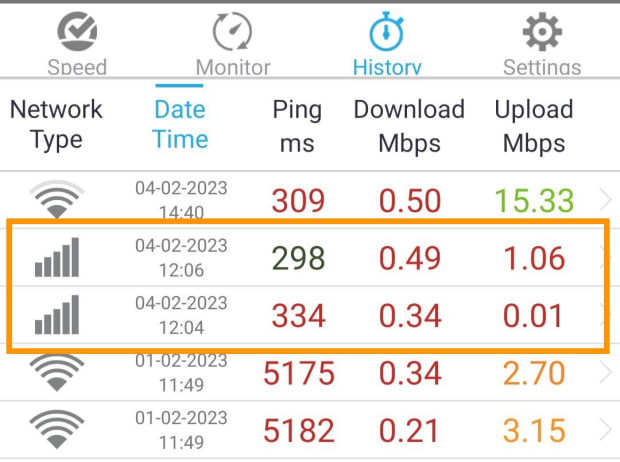

The mobile internet speed at the time of testing in February 2023:

I hadn’t tested it, but I had the impression that Android was handling the low internet speed better than iOS. At the location where I tested, I had 3G on an iPhone and H+ on an Android device. Now that I’m writing this article, I researched the difference and learned that H+ delivers much higher speeds than normal 3G.

I did two tests, one at Lake Mutirikwi and one in Great Zimbabwe. I announced on Twitter that I was going to send bitcoin to the first three people who sent me an invoice.

I did the first couple of tests at the dam of Lake Mutirikwi. I tested Breez, Zeus and Blue Wallet on an iPhone and Phoenix and Zap on an Android device. The following day, I did some more tests.

Reviewing Lightning Wallets

Machankura 8333

Machankura 8333 is a service that allows users to send and receive bitcoin via Lightning without an internet connection. Millions of people on the African continent are using feature phones. Machankura is using a technology called USSD code, just like the mobile money providers M-Pesa or EcoCash do. USSD stands for unstructured supplementary service data. You dial a code on the phone and a menu opens, which you navigate through by typing numbers. I’ve used Machankura to send and receive Lightning bitcoin in Zambia.

It’s important to note that Machankura 8333 is a custodial solution and very new. Because of its dependency on permission from centralized mobile network providers, its adoption is uncertain. Machankura is not available in Zimbabwe and, therefore, not a part of this test.

Wallet Of Satoshi

One of the fastest and easiest to use Lightning wallets is Wallet of Satoshi. I’ve seen many people using it on their phones, for instance in South Africa, Ghana or Zambia. It is always introduced as the most convenient and easiest solution for beginners. And it is true: it works great, even in remote areas with limited bandwidth and it is the only wallet as far as I know that gives you a Lightning Network address (alternatively, you can use Alby and Blue Wallet). Wallet of Satoshi has big downsides though.

First: It is a custodial solution. Your funds are being held by the company behind it. You need to trust it. Second: It is not open source. Nobody except the wallet developers can read and revise the code, which is completely antithetical to Bitcoin, whose unique position stems from being decentralized and open source. For me, I stay away from Wallet of Satoshi. That’s why I didn’t include it in the test.

Blue Wallet

I really like Blue Wallet, mainly for its ease of use and the possibility to use Bitcoin on-chain and through Lightning in the same app. But it has a downside: While on-chain funds are held in a non-custodial way, so that you and only you have the seed words and are the owner of your bitcoin, the Lightning wallet is custodial. If you run your own Lightning node, you can connect it as a remote for your node. Then Blue Wallet is a great solution, but if you have to use the wallet’s default Lightning settings, be careful and only store small amounts of bitcoin there. Everything else you should move over to your self-custodied, on-chain wallet.

Another upside of Blue Wallet is that you can integrate a Lightning address with a custodial wallet from Alby. You set up an account at Alby, choose a Lightning address and import it into Blue Wallet. There you can see incoming funds and also send them.

Muun

The Muun wallet is a very user-friendly, non-custodial Bitcoin wallet, which is often promoted as a Lightning wallet even though all your coins are stored on chain. Unlike Blue Wallet, where Lightning and on-chain Bitcoin are represented as two wallets with two balances, Muun wallet shows one balance. Users don’t need to decide if they should do a Lightning or an on-chain payment. The wallet selects the appropriate method automatically.

Why is Muun not my favorite? Because of its backup method. The standard for self custody is a seed phrase. This is what has been taught over the last few years and what I believe will be the standard in the foreseeable future. When I explain self custody to participants of my meetups or workshops, securing the seed phrase is always the most important part. Suddenly, this works differently for Muun. As long as there are true self-custodial Lightning wallet alternatives that are working with the seed phrase or an easier backup mechanism, I will emphasize those. For instance, Breez or Phoenix.

Breez

The Breez app brings a Lightning node to your smartphone. It stores your money in full self custody. You will need a Google Drive, Apple iCloud or to use a remote server to backup, though. Since many people in African countries don’t fulfill these requirements, it is not possible for them to use Breez. That’s a pity because, besides being a Lightning wallet, it serves as a Value4Value podcast player and a point-of-sale application for businesses.

Phoenix

Like Breez, Phoenix is a self-contained Lightning node that gives you full access to your funds. It is non-custodial and offers a 12-word seed as backup. You can send your Lightning funds to an on-chain Bitcoin address (this is called “swap out”). The only downside is that you must receive at least 10,000 satoshis ($2.15 at the time of writing) to initialize a new wallet. This is the minimum amount for a new payment channel to be created. This requirement can be a problem for people with lower incomes. There is a little bit of trust involved while doing swaps and channel openings but in general it is a real, self-contained Lightning node that runs on your phone. You are in full control of your funds.

Running Your Own Node? Zeus And Zap

Zeus and Zap are wallets that you can use as a remote for your own node. You can also connect Blue Wallet with your node, and then it is a great Lightning wallet.

I’m running a Lightning node on Voltage. It is not fully self hosted, I need to trust Voltage, but as a nomad, I can’t run my own node at the moment. I have Zeus connected with my node on my iPhone and Zap on my Android. That’s the configuration I did in my first Lightning test in rural Zimbabwe in September 2022.

Test Results

As stated above, I was under the impression that Android handled the low speed better than my iOS would. I tested Muun, Blue Wallet, Zeus and Breez on iOS, and Phoenix and Zap on Android.

Muun

I sent one payment from Muun and had no issues.

Blue Wallet

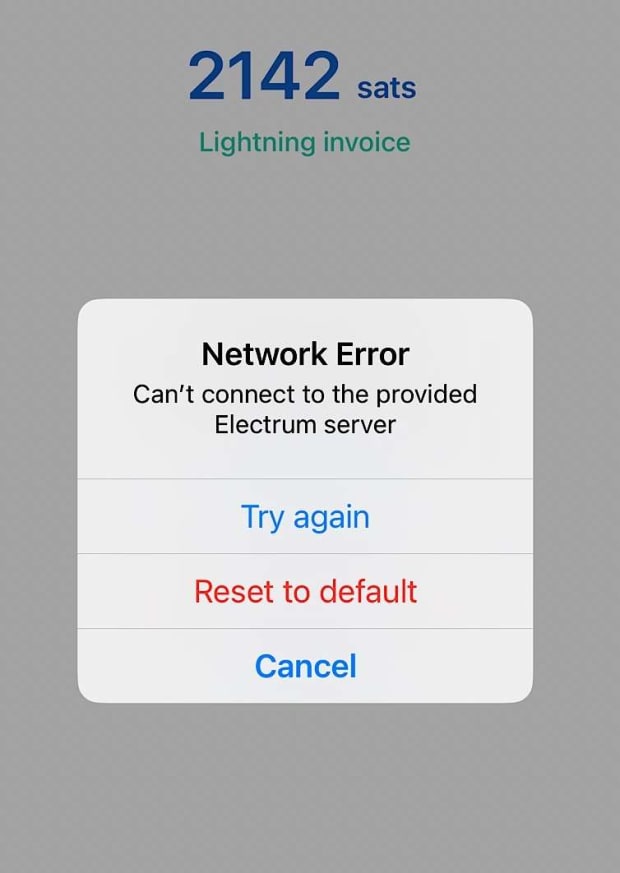

I had some connectivity issues, as you can see in the photo, but I was able to send and receive payments.

Zeus

I sent four payments. Sometimes, the wallet timed out because it lost connection to the node, but after re-opening the app, it worked.

Zap

My Zap wallet never connected with my node.

Breez

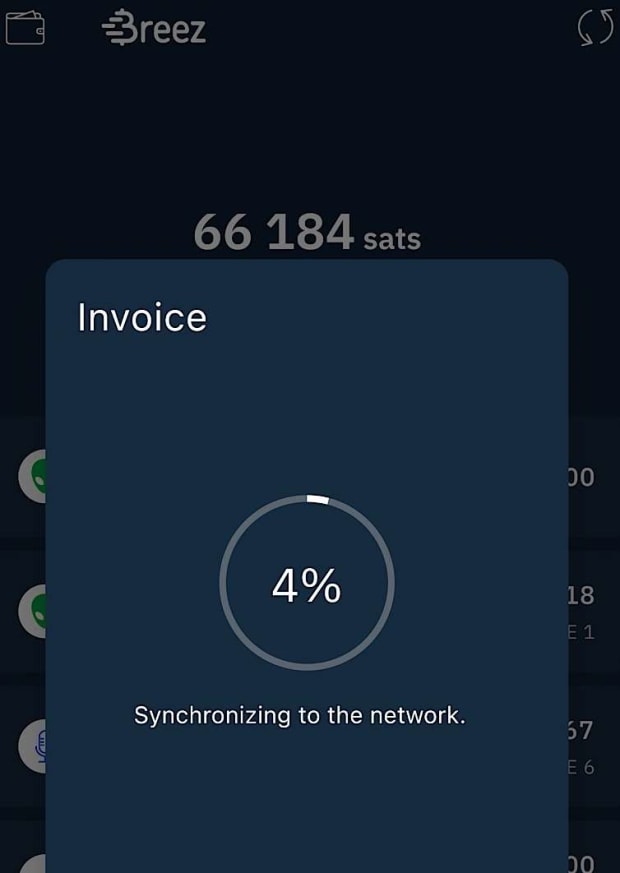

This was sadly not working. The process of loading the app started, but after a while I stopped because it never finished loading. It is a fantastic app and the channel creation requires only a minimum amount of 2,000 sats (compared to 10,000 with Phoenix), so in areas with good internet connection I fully recommend it.

Phoenix

I sent and received several payments successfully without any problems.

Wallet Overview

Fees

It is really difficult to make a fee comparison, because the functionalities under the hood of the wallets are different. The uncertainty of the underlying fees on the Bitcoin blockchain factor in as well, because when a channel is being opened or a swap-out to a Bitcoin address happens, they have to be paid for too.

That’s why I didn’t even try to make a fee comparison. The possibility to own censorship-resistant money, that one can send globally, that’s settled instantly and works permissionlessly without any transaction limits, is priceless. It is already cheaper than any other form of international payment.

Just recently, someone sent me $2,500 from his bank account in another country to mine. I now have $2,466 in my account. The fee on his side was $20 on top of the $2,500. Additionally, there was a $4.14 fee on my side. That means in between, someone (and we have no clue who) took $30. He paid $2,520, I have $2,466 in my account — we paid $54 in fees. And yet the money is not even exchanged to euros.

Conclusion

In only 10 minutes (messaging on Twitter included), I had sent and received bitcoin in Zimbabwe from several countries, like Benin, Nigeria, Bangladesh, Germany, the U.K. and Italy, all that without the need of showing an ID or getting permission from anyone and without any transaction limits and very low fees. This is what financial sovereignty and inclusion is all about.

What’s the best solution for you? The best solution is the one that fits your personal needs best. As you can see in the above table, every wallet has different features, as well as up- and downsides. It is on you to figure out your needs and possibilities and then to find the optimal solution for those.

For new users, Phoenix and Breez are great solutions. Given the fact that I wanted to find the best wallet working in areas with weak internet connectivity, I recommend Phoenix. It is a non-custodial wallet, easy to use and swap-outs to the Bitcoin blockchain are free (except for the mining fees) and it works with a seed backup. The only downside is that you must receive at least 10,000 satoshis ($2.15 at the time of writing) as a first payment to initialize a new wallet. This requirement can be a problem for people with very low incomes.

I hear over and over again that Wallet of Satoshi is a great wallet to start with, because its use is simple and convenient. Most of the invoices I received during my test were actually sent from Wallet of Satoshi. This freaks me out. The usual recommendation to use only a small amount of funds, because of the custodianship, cannot be applied to lower-income users. A loss of $2 can be huge for them. I don’t see any reason anymore to recommend a closed-source, custodial wallet like Wallet of Satoshi over a permissionless, self-custodial wallet like Phoenix or Breez.

The requirement of Phoenix to receive a first time payment of 10,000 satoshi is a barrier to be acknowledged, but a person who doesn’t have the funds to receive 10,000 satoshi will suffer from the loss of the same amount in a custodial wallet even more. As I said above, it is every person’s own decision which route to take, but I find it important that people understand the risks of using custodial wallets at this early stage.

Non-custodial Lightning wallets might be a little less convenient to use and come with an initial cost when setting up the channels, but you are in full control over your own funds. You are financially sovereign.

Furthermore, I am optimistic that Bitcoin developers and entrepreneurs will find solutions to make self custody even more convenient and lower the barrier of entry in the coming years.

This is a guest post by Anita Posch. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo