[ad_1]

In a post shared on X on January 26, crypto analyst BitQuant forecasts that Bitcoin (BTC) will recover from the current downtrend and surge past its all-time high of $69,000 to over $250,000 before the upcoming Bitcoin halving in April.

Bitcoin To $250,000 Before Halving?

From the chart shared, BitQuant notes that Bitcoin is still trending inside a rising channel. Out of the multi-year uptrend that the coin is in, this channel’s next “touch” is projected to be at around $250,000.

For now, if the trend line guides, Bitcoin has immediate resistance at about $80,000. This level should be the next key target for bulls to retest. According to BitQuant, it is likely that Bitcoin will float above this line to $250,000 by April before the network automatically halves block mining rewards.

Extrapolating from the analyst’s preview, the Bitcoin uptrend remains valid until the upper limit defined by the rising trend line is “touched.” Even so, when this level will be breached is not specified.

Once this line is tested, placing the coin at over $250,000, it will likely follow its historical pattern by cooling off. The depth of this retracement is not also defined but is expected to be deep since BitQuant said the coin will “die.”

BitQuant explained that this “dying” period refers to Bitcoin’s price going below its previous all-time high. The retracement will be expected. This is common after halving since supply tends to increase as demand for the coin softens. Despite this temporary setback, BitQuant remains confident that BTC will regain momentum and continue its long-term upward trend.

Though the analyst remains bullish, it is unclear how prices will pan out for now. The United States Securities and Exchange Commission (SEC) recently approved multiple spots for Bitcoin exchange-traded funds (ETFs).

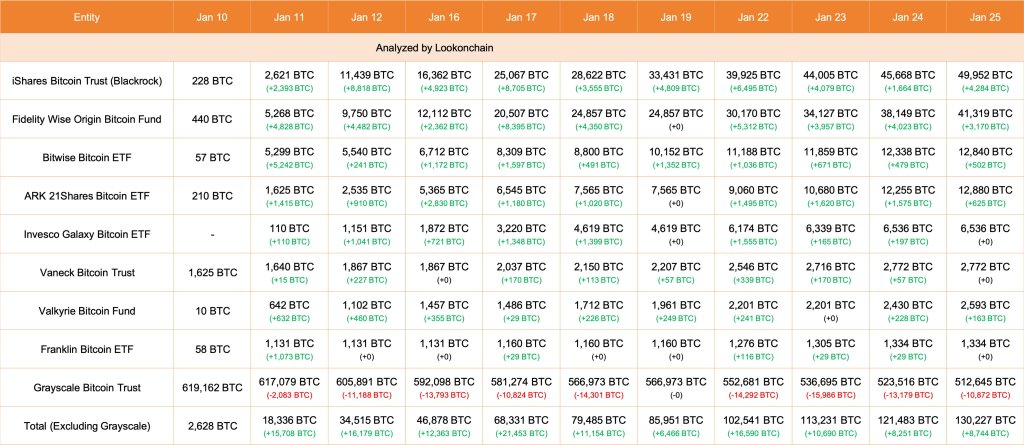

Though issuers have been ramping up purchases, Grayscale Investments have liquidated their Grayscale Bitcoin Trust (GBTC), selling shares and dumping coins via exchanges.

Recent data from Lookonchain reveals that GBTC reduced 10,872 BTC worth over $447 million on January 25. Meanwhile, eight spot Bitcoin ETF issuers added 8,744 BTC, with BlackRock adding 4,284 BTC. On January 24, GBTC reduced 13,179 BTC with Fidelity Investments, another spot Bitcoin ETF issuer, buying 4,023 BTC.

With BTC finding demand, prices have started stabilizing, looking at the development in the daily chart. The coin is steady above $39,500, rejecting the intense selling pressure of January 22.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link

My NEO Group:

– White paper My NEO Group: https://myneo.org

– Discover NEO X: https://docs.myneo.org/products/in-development/neo-x

– Disccover NEO Dash: https://myneodash.com

– Discover Banca NEO: https://bancaneo.org

– Interview of the CEO of My NEO Group, Mickael Mosse, in Forbes: https://forbesbaltics.com/en/money/article/mickael-mosse-affirms-commitment-to-redefining-online-banking-with-bancaneo